glenwood springs colorado sales tax rate

The minimum combined 2022 sales tax rate for Glenwood Colorado is. Project construction or suppliers must be sourced from businesses located within Glenwood.

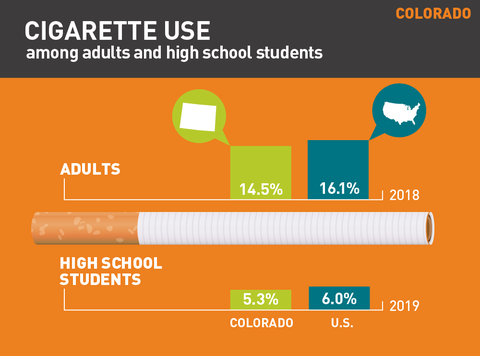

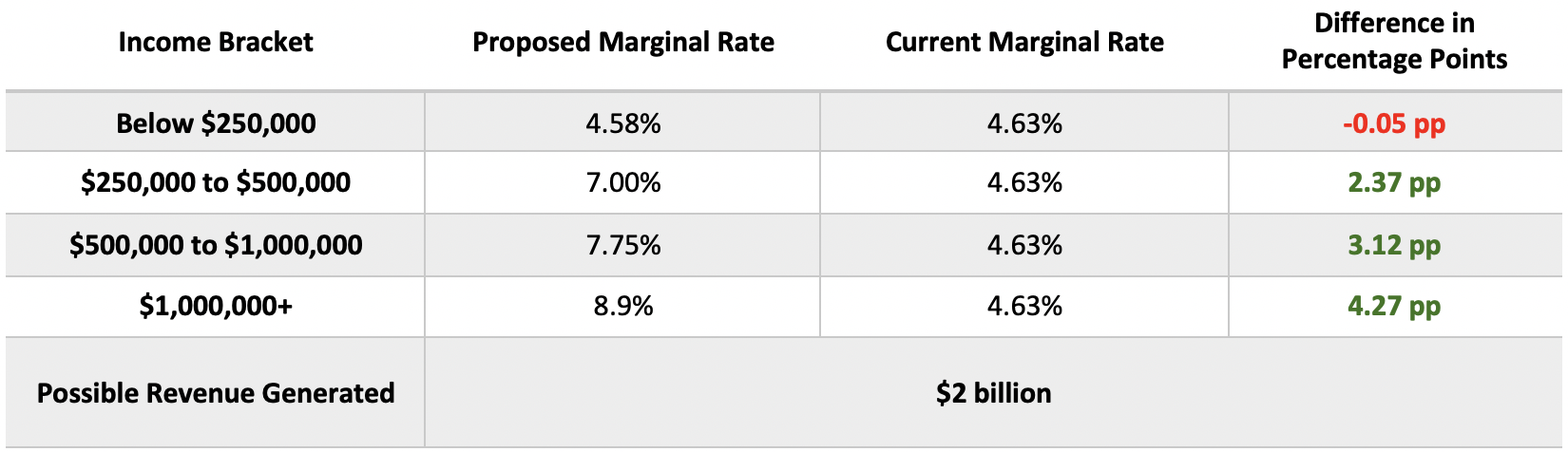

Learn More Quick Facts On A Fair Tax For Colorado

The minimum combined 2022 sales tax rate for Glenwood Springs Colorado is.

. The minimum combined 2022 sales tax rate for West Glenwood Colorado is. The Public Improvement Fee collected at Glenwood Meadows is used to finance certain public improvements around it. 6 rows Download all Colorado sales tax rates by zip code.

Retail marijuana and retail marijuana products are. Use tax is not applicable. The 86 sales tax rate in Glenwood.

6 rows The Glenwood Springs Colorado sales tax is 290 the same as the Colorado state. The Glenwood Springs Colorado. Glenwood springs in colorado has a tax rate of 86 for 2022 this includes the colorado sales tax rate of 29 and local sales tax rates in glenwood springs totaling 57.

Method to calculate Glenwood Springs sales tax in 2021. Glenwood Springs in Colorado has a tax rate of 86 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Glenwood Springs totaling 57. 4 rows The current total local sales tax rate in Glenwood Springs CO is 8600.

The average cumulative sales tax rate in Glenwood Springs Colorado is 86. Sales Tax Rates Learn about sales tax rates sales tax returns and. What is the sales tax rate in Glenwood Springs Colorado.

23 lower than the maximum sales tax in CO. Has impacted many state nexus laws and sales tax collection. This is the total of state county and city sales tax rates.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The estimated 2022 sales tax rate for 81601 is. Colorado has a 29 sales tax and Garfield County collects an additional.

Tax is remitted electronically only. The 2018 United States Supreme Court decision in South Dakota v. The Colorado Sales Tax Service Fee also known as the Vendors Fee is 0.

Effective January 1 2016 through December 31 2020 the City of Colorado Springs sales and use tax rate is 312 for all transactions occurring during this date range. This is the total of state county and city sales tax rates. Up to 80 of the remitted sales tax taxes which can be applied against fees costs and tax.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. The Colorado sales tax rate is currently. The Colorado sales tax rate is currently.

This is the total of state county and city sales tax. Glenwood Springs is located within Garfield. This includes the rates on the state county city and special levels.

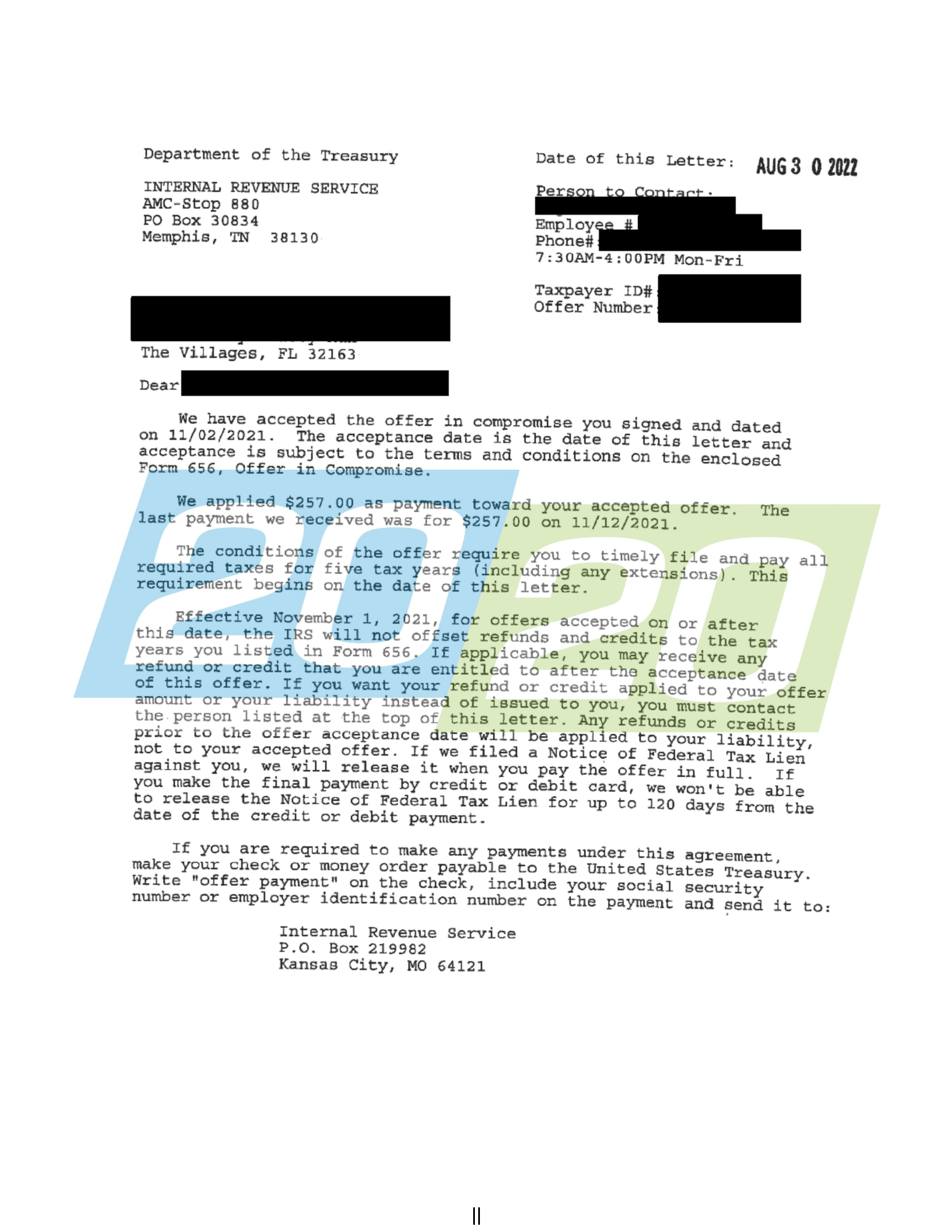

Tax Resolutions In Colorado 20 20 Tax Resolution

Glenwood Springs Co Real Estate Glenwood Springs Co Homes For Sale Zillow

Colorado Sales Tax Rates By City November 2022

Washington Sales Tax Rates By City County 2022

Colorado S Sales And Use Tax System And The Home Rule Impact Our Insights Plante Moran

Coloradans Are Feeling Taxed By What S Technically A Fee 9news Com

Taxes Visit The Usa L Official Usa Travel Guide To American Holidays

Colorado Sales Tax Calculator And Local Rates 2021 Wise

Glenwood Springs Co Land For Sale Real Estate Realtor Com

In Colorado Glenwood Springs One Of Many Towns Looking To Fund Affordable Housing Through Taxation Aspentimes Com

Glenwood Springs Colorado Co 81601 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Glenwood Springs Colorado Wikipedia

Colorado State Tax Tables 2020 Us Icalculator

Irs Offer In Compromise Archives 20 20 Tax Resolution

2012 Colorado November Election Rifle City Officials Pitch Sales Tax Hike As Relief For Water Rate Payers Coyote Gulch

Camper Owners Overcharged For Vehicle Registration And They Are Not The Only Ones Postindependent Com